As we approach 2025, staying informed about the evolving crypto landscape is not just beneficial; it's essential. With rapid technological advancements and changing regulations, understanding key trends can empower your investment decisions. Are you ready to navigate this dynamic world of cryptocurrencies?

What You Will Learn

- Market volatility is expected to persist, driven by macroeconomic factors and investor sentiment.

- Institutional adoption of cryptocurrencies is on the rise, contributing to market legitimacy and stability.

- Decentralized finance (DeFi) continues to disrupt traditional banking, offering innovative financial solutions.

- Regulatory changes, including the GENIUS ACT, will significantly impact the crypto market landscape in 2025.

- Understanding market capitalization trends of leading cryptocurrencies is vital for assessing market health.

- Adopting effective risk management strategies can safeguard your investments in a volatile market.

- Emerging technologies, such as AI and enhanced blockchain solutions, are set to transform the crypto space.

- Engaging with the crypto community can provide valuable insights and enhance your investment knowledge.

Key Trends Shaping the Crypto Market Towards 2025

This visual highlights the most impactful areas influencing the crypto market for investors in 2025, from institutional adoption to technological advancements.

Institutional Adoption

Expected to rise significantly, bringing capital, credibility, and stability to the market.

DeFi Reshaping Finance

Decentralized finance will continue to disrupt traditional banking and investment practices.

Evolving Regulations (GENIUS ACT)

New frameworks like the GENIUS ACT will create compliance challenges and new opportunities.

Technological Innovations (AI & Blockchain)

AI for market analysis and blockchain scalability solutions will drive significant advancements.

Understanding the 2025 Crypto Market Landscape

As we look toward 2025, the crypto market landscape is poised for significant transformation. For investors, it’s crucial to grasp the trends that will shape this environment. With over a decade in the cryptocurrency space, I’ve seen firsthand how swiftly things can change. Let's dive into the essential insights and trends affecting the market over the next few years!

In this section, we'll explore key trends, regulatory updates, and market dynamics that are critical for any investor looking to navigate the evolving world of cryptocurrencies. From institutional adoption to technological innovations, understanding these factors will empower you to make informed investment decisions.

Investor Insights: Key Trends Shaping the Crypto Market

To stay ahead, we must recognize the trends influencing the market's direction. Here are some critical trends to monitor:

- Market volatility will likely continue, influenced by various macroeconomic factors.

- Institutional adoption is expected to rise, enhancing the legitimacy of cryptocurrency.

- Decentralized finance (DeFi) will reshape traditional banking and investment practices.

- Technological advancements, particularly in blockchain, will drive innovation.

As we assess these trends, it's vital to understand their impact on market prices and investor sentiment. Anticipating these changes is key to positioning yourself for success in 2025!

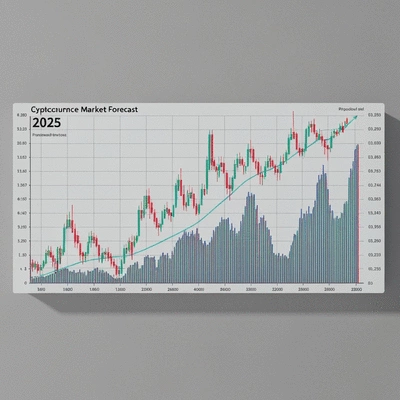

Market Trends and Price Forecasts for 2025

Market analysts are predicting a mixed landscape for cryptocurrency prices in 2025. Factors such as inflation, regulatory changes, and technological advancements will play significant roles. I encourage you to keep an eye on prominent cryptocurrencies like Bitcoin and Ethereum, as they often set the stage for overall market performance.

Additionally, it's essential to familiarize yourself with various price forecasting methods. By understanding different approaches, you can better anticipate potential market movements!

Impact of Institutional Adoption on Cryptocurrency Values

In recent years, institutional investors have begun to enter the cryptocurrency space, bringing with them substantial capital and credibility. This trend is likely to intensify in 2025, as more businesses recognize the potential of digital assets. Institutional participation tends to stabilize prices and enhance market confidence. For a deeper dive into the state of crypto, you can find valuable insights from reports like the State of Crypto Q3 2025 Report, which details current trends and forecasts.

Moreover, this influx could lead to increased liquidity and reduced volatility, making cryptocurrencies more appealing to mainstream investors. As we navigate this changing landscape, don't forget to consider the implications of such developments on your investment strategies!

Evaluating Market Capitalization of Major Cryptocurrencies

Market capitalization is a critical metric for understanding the overall health of the cryptocurrency market. Watching how the market cap of leading coins fluctuates will provide valuable insights into investor sentiment. I recommend focusing on:

- The top 10 cryptocurrencies by market cap for stability and growth potential.

- The emergence of new projects that could disrupt established players.

- Market cap trends as indicators of broader market movements.

Utilizing market cap data effectively can empower you to make strategic investment decisions as we approach 2025!

Navigating the Evolving Regulatory Environment

As the crypto market matures, so does the regulatory environment surrounding it. Understanding these regulations is vital for all investors looking to thrive in the upcoming landscape. Here’s what to watch for:

- New regulations may introduce compliance challenges but also opportunities for innovation.

- Understanding the implications of major laws like the GENIUS ACT will be crucial.

- Tax policies will continue to evolve, impacting how we report and pay on our investments.

Staying informed on these regulatory changes will not only protect your investment but also allow you to seize new opportunities as they arise!

Key Regulations Affecting the Crypto Market in 2025

Key regulations will shape the landscape of cryptocurrency in 2025. Governments worldwide are establishing frameworks to regulate digital assets, aiming to protect investors while fostering innovation. For example, the U.S. Treasury's statements on digital asset policy highlight ongoing efforts to balance innovation with financial stability.

Pay attention to:

- How regulations differ across regions.

- The potential for harmonized regulations that facilitate cross-border trading.

- Future regulatory developments that could impact market accessibility.

Being proactive in understanding these regulations is essential for successful investment in the crypto space!

Understanding the GENIUS ACT and Its Implications

The GENIUS ACT is one of the most talked-about pieces of legislation in cryptocurrency circles. It proposes a framework for regulating digital assets, and its implications are vast. Here’s what you should consider:

- The act aims to create a stable environment for crypto businesses.

- It could affect the classification of cryptocurrencies, impacting taxation and compliance.

- By promoting transparency, it may enhance investor confidence in the market.

Understanding the nuances of the GENIUS ACT will be crucial as it shapes investment strategies in the coming years.

Tax Implications for Cryptocurrency Investments in 2025

Taxation on cryptocurrency investments is a hot topic and will continue to evolve. Investors should prepare for changes that could affect their returns. Key areas to understand include:

- How capital gains taxes will apply to cryptocurrency transactions.

- The importance of proper record-keeping to ensure compliance.

- Potential deductions or credits that may be available for crypto investors.

By staying informed about the tax implications, you can maximize your returns and avoid unwanted surprises come tax season!

Venture Capital Activity and Its Influence on Market Dynamics

Venture capital (VC) plays a pivotal role in the cryptocurrency ecosystem by funding innovative projects. In 2025, we can expect continued interest from VC firms, leading to exciting developments. Here are some key indicators of this activity:

- Funding rounds for blockchain projects are expected to increase.

- Strategic mergers and acquisitions could reshape the market landscape.

- Identifying promising startups will be vital for investors seeking high returns.

Keeping an eye on VC trends will enable you to spot lucrative investment opportunities in the crypto market!

Current Trends in Crypto Funding and M&A Activity

Recent data suggests that funding for crypto startups has been on the rise, driven by the increasing interest in blockchain solutions. In 2025, look for significant M&A activity, as established firms seek to integrate innovative startups into their offerings. Key trends to watch:

- A surge in funding for DeFi projects and applications.

- Collaborations between tech giants and blockchain startups.

- Emergence of new players in the crypto exchange space.

Understanding these trends will help you align your investment strategy with the evolving market dynamics!

Identifying Promising Investment Opportunities in 2025

As venture capital flows into the crypto sector, identifying promising investment opportunities becomes crucial. Here’s how you can approach this:

- Look for projects with strong use cases and viable business models.

- Monitor the backgrounds of founding teams and their expertise.

- Consider the potential for partnerships and collaborations in the industry.

With careful analysis, you can position yourself ahead of emerging trends and capitalize on new opportunities in the crypto sphere!

Impact of Security Token Offerings (STOs) on Market Growth

Security Token Offerings (STOs) are gaining traction as a regulated way to raise capital. As we move into 2025, the growth of STOs could significantly impact the market. Consider these points:

- STOs may attract traditional investors looking for compliant options.

- They could lead to increased liquidity in the crypto market.

- Regulatory clarity surrounding STOs may foster innovation.

By understanding the potential of STOs, you can better navigate the future landscape of cryptocurrency investing!

Technological Innovations Transforming the Crypto Space

Technological innovations are at the forefront of the cryptocurrency revolution. As we advance towards 2025, keep an eye on the following trends:

- Artificial Intelligence (AI) will play a growing role in market analysis.

- Blockchain scalability solutions will enhance transaction speeds.

- Decentralized finance (DeFi) will continue to disrupt traditional finance.

Embracing these innovations will be key to staying competitive in the ever-changing landscape of crypto investment!

The Role of AI in Shaping Cryptocurrency Trends

AI technology is revolutionizing how we analyze and predict cryptocurrency trends. By improving our ability to process data, AI can provide insights into market behavior, trading patterns, and investment strategies. Here’s what to watch for:

- Increased adoption of AI tools for trading and risk assessment.

- AI-driven analytics platforms providing real-time market insights.

- Potential partnerships between AI firms and blockchain developers.

Utilizing AI in your investment strategy may offer a competitive edge in 2025!

Blockchain Infrastructure Developments to Watch

As blockchain technology matures, infrastructure improvements will enhance the overall ecosystem. Notable developments to keep an eye on include:

- Scalability solutions such as Layer 2 technologies.

- Interoperability between different blockchain platforms.

- Advancements in consensus mechanisms for improved security.

Staying informed about these developments will help you make strategic decisions in the evolving crypto landscape!

Exploring Decentralized Finance (DeFi) and Its Impact

DeFi is reshaping how we think about finance, offering new models for banking and investment. As we approach 2025, here are the key impacts of DeFi to consider:

- Expansion of lending and borrowing platforms.

- Increased access to financial services for unbanked populations.

- Innovation in yield generation and liquidity provision.

Understanding DeFi’s potential will empower you to capitalize on new financial opportunities!

Assessing Market Metrics and Analytics for Informed Decisions

To make informed investment choices, it's essential to evaluate market metrics effectively. Key metrics to monitor include:

- Volatility indexes that measure market fluctuations.

- Trading volumes to gauge market activity.

- Adoption indexes tracking user growth and engagement.

By analyzing these metrics, you can gain valuable insights into market trends and make well-informed decisions!

Analyzing Crypto Volatility and Adoption Indexes

Market volatility is an inherent aspect of the cryptocurrency landscape. Understanding how to interpret volatility and adoption metrics is vital for investors. Consider these points:

- High volatility can present both risks and opportunities.

- Adoption rates are critical indicators of long-term value.

- Tracking market sentiment can help predict price movements.

By analyzing these factors, you can position yourself strategically to navigate the crypto market with confidence!

Decoding Trading Volumes and Their Market Impacts

Trading volumes serve as a barometer for market activity and investor interest. High trading volumes can indicate strong market sentiment and potentially lead to price movements. Here are some aspects to consider:

- Comparing trading volumes across different exchanges.

- Assessing the impact of volume spikes on market trends.

- Understanding the relationship between trading volumes and price volatility.

Keeping track of these metrics will enhance your ability to make strategic trading decisions!

Understanding Market Sentiment in Cryptocurrency Trading

Market sentiment plays a crucial role in shaping the cryptocurrency landscape. Gauging sentiment helps investors anticipate changes in market behavior. Here’s how to analyze sentiment effectively:

- Monitoring social media trends and news coverage.

- Using sentiment analysis tools to track public opinion.

- Observing the correlation between sentiment and price movements.

By honing your understanding of market sentiment, you can make more informed investment choices as we move into 2025!

FAQs About the 2025 Crypto Market Landscape

Here are some frequently asked questions to help you better understand the crypto market as we approach 2025:

- Q: What are the primary trends expected to shape the crypto market in 2025?

- A: Key trends include increased institutional adoption, the continued growth and disruption by Decentralized Finance (DeFi), evolving regulatory frameworks (like the GENIUS ACT), and significant technological advancements such as AI and enhanced blockchain solutions.

- Q: How will institutional adoption impact cryptocurrency values?

- A: Institutional adoption is expected to bring substantial capital, credibility, and stability to the market. This often leads to increased liquidity, reduced volatility, and enhanced market confidence, making cryptocurrencies more appealing to a broader range of investors.

- Q: What is the GENIUS ACT, and why is it important for crypto investors?

- A: The GENIUS ACT is proposed legislation aimed at creating a regulatory framework for digital assets. It's important because it could affect the classification of cryptocurrencies, influence taxation and compliance requirements, and enhance investor confidence through increased transparency.

- Q: How can AI influence cryptocurrency trends and investment strategies?

- A: AI technology is revolutionizing market analysis and predictions. It can provide insights into market behavior, trading patterns, and optimal investment strategies by processing vast amounts of data, offering investors a competitive edge.

- Q: What risk management strategies are recommended for crypto investors in 2025?

- A: Recommended strategies include diversifying portfolios across various cryptocurrencies, setting stop-loss orders to limit potential losses, regularly reviewing and adjusting investment strategies, utilizing dollar-cost averaging, and staying informed about regulatory changes.

Risk Management Strategies for 2025 Crypto Investors

Investing in cryptocurrencies involves inherent risks, making effective risk management essential. In 2025, consider these strategies to protect your investments:

- Diversifying your portfolio across various cryptocurrencies.

- Setting stop-loss orders to limit potential losses.

- Regularly reviewing and adjusting your investment strategy.

By proactively managing risks, you can safeguard your investments and navigate the uncertainties of the crypto market with confidence!

Understanding Market Volatility and Its Implications

Market volatility can create opportunities, but it also presents challenges for investors. Understanding its implications is vital for making informed decisions. Key considerations include:

- The causes of volatility, ranging from market sentiment to external events.

- How to leverage volatility for profit potential.

- The importance of emotional discipline during turbulent times.

By understanding market volatility, you can tailor your investment strategies to minimize risks!

Effective Risk Mitigation Techniques for Crypto Investment

Mitigating risks in cryptocurrency investments requires a multi-faceted approach. Here are some effective techniques:

- Utilizing dollar-cost averaging to spread out investment risk.

- Staying informed on regulatory changes that may impact your holdings.

- Engaging with the community to share insights and strategies.

Implementing these techniques will enhance your resilience in the ever-changing crypto landscape!

Strategies for Managing Investments in a Bear Market

Navigating a bear market requires a well-thought-out strategy. Here are some approaches to consider:

- Focusing on long-term value investments over short-term gains.

- Identifying strong projects with solid fundamentals.

- Staying calm and avoiding panic selling.

By employing these strategies, you can manage your investments effectively, even in challenging market conditions!

Global Adoption Trends: A Comparative Analysis

As cryptocurrency adoption continues to grow, examining global trends provides valuable insights. Key areas to consider include:

- Regional differences in adoption rates and preferences.

- Emerging markets poised for significant growth in 2025.

- The influence of Central Bank Digital Currencies (CBDCs) on traditional cryptocurrency use.

Understanding these trends will empower you to navigate the global landscape of cryptocurrency and invest wisely!

Regional Differences in Crypto Market Adoption

Adoption rates for cryptocurrencies vary significantly across regions. Understanding these differences can inform your investment strategy. Key observations:

- North America and Europe are leading in regulatory developments.

- Asia remains a hotspot for innovation and venture capital.

- Africa shows immense potential due to the unbanked population.

By recognizing these regional dynamics, you can position your investments to take advantage of growing markets!

Emerging Markets and Their Potential in 2025

Emerging markets present unique opportunities for cryptocurrency adoption. As we move toward 2025, consider the following:

- Countries with limited access to traditional banking systems are prime candidates for crypto adoption.

- Local regulations will play a vital role in shaping the growth of these markets.

- Cultural attitudes towards cryptocurrencies will influence adoption rates.

Investing in emerging markets can unlock significant growth potential in the coming years!

Trends in Central Bank Digital Currency (CBDC) Adoption

Central Bank Digital Currencies (CBDCs) are gaining traction as governments explore digital alternatives to traditional currencies. For insights into the ongoing discussions and considerations surrounding CBDCs, the Federal Reserve's perspectives on digital assets and CBDCs offer a relevant viewpoint.

Here’s what to watch:

- The impact of CBDCs on the existing cryptocurrency landscape.

- How CBDCs may facilitate easier access to digital assets.

- The role of CBDCs in shaping monetary policy and financial systems.

Understanding the implications of CBDCs will be crucial for navigating the future of cryptocurrency investing!

Aligning Crypto Trends with ESG Considerations

As more investors seek to align their portfolios with ethical considerations, understanding the impact of Environmental, Social, and Governance (ESG) principles on cryptocurrency is crucial. Here’s what to consider:

- The growing emphasis on sustainability in crypto projects.

- How ESG factors can influence investment decisions and valuations.

- The role of governance tokens in promoting responsible practices.

By integrating ESG considerations into your investment strategy, you can support positive change while pursuing financial growth!

Impact of Sustainability Initiatives on Investor Decisions

Investors are increasingly considering sustainability when making investment choices. In the crypto space, this trend is crucial as:

- Projects that prioritize sustainability may attract more interest and investment.

- Transparency around energy consumption is becoming a key factor.

- Investors may favor cryptocurrencies with clear ESG commitments.

By acknowledging these trends, you can position yourself to make investment choices that align with both your values and financial goals!

Evaluating Environmental Concerns in Crypto Investments

Environmental concerns are a significant topic in the cryptocurrency community. As we approach 2025, consider how these issues play a role in your investment strategy:

- Understanding the carbon footprint of various cryptocurrencies.

- Evaluating projects focused on renewable energy solutions.

- Supporting initiatives aimed at reducing environmental impact.

Being mindful of these concerns can help you make more informed investment decisions that reflect your values!

Assessing the Role of Governance Tokens in Sustainable Practices

Governance tokens are gaining attention for their potential to promote sustainable practices within crypto projects. Key aspects to consider include:

- How governance structures can influence project direction towards sustainability.

- The impact of community engagement on fostering responsible practices.

- Opportunities for investors to participate in the governance process.

By understanding the role of governance tokens, you can make more strategic investments that align with sustainable values!

Pro Tip

As you navigate the evolving crypto landscape, consider leveraging technical analysis tools. These tools can help you identify trends and make data-driven decisions. Utilizing platforms that provide real-time analytics can enhance your ability to anticipate market movements and position your investments more strategically.

Future Outlook: What Investors Should Anticipate in 2025

As we look towards 2025, it's important to consider the dynamic shifts that will undoubtedly reshape the crypto landscape. With rising technological advancements, regulatory changes, and evolving market trends, investors must stay ahead of the curve. At Uncensored Crypto, we're dedicated to providing you with the insights you need to navigate this exciting terrain!

So, what can investors expect? Here are a few key areas to focus on:

- Increased institutional participation

- Advancements in decentralized finance (DeFi)

- Regulatory frameworks influencing new projects

- Emerging technologies like AI and blockchain interoperability

By keeping an eye on these trends, you'll be better equipped to anticipate shifts in the market and position your investments accordingly.

Preparing for the Evolving Crypto Landscape

Preparation is crucial in a landscape as volatile as cryptocurrency. With the evolution of the crypto market, investors need to embrace a proactive approach. This means not only staying informed about the latest trends but also developing a flexible investment strategy that can adapt to changing conditions.

Here are some essential steps to prepare:

- Stay updated on market news and developments

- Follow reputable sources, like Uncensored Crypto, for unbiased insights

- Engage in community discussions to gain diverse perspectives

By adopting these practices, you'll not only enhance your knowledge but also build a network of fellow investors who can offer valuable insights!

Strategies for Capitalizing on Emerging Opportunities

As new opportunities arise, it’s vital to have strategies that allow for quick adaptation. Some of the promising areas to explore in 2025 include emerging cryptocurrencies, innovative technologies, and decentralized finance platforms. Here’s how you can capitalize on these opportunities:

- Research new projects thoroughly before investing

- Consider diversifying your portfolio to mitigate risks

- Utilize analytical tools to assess potential investments

These strategies can help you identify and seize opportunities as they emerge, ensuring that you're not left behind in the fast-paced crypto world!

Exploring Yield Farming and Staking as Investment Strategies

Yield farming and staking present exciting avenues for generating passive income in the crypto space. Both strategies allow investors to earn rewards through their cryptocurrency holdings, providing an alternative to traditional investment methods.

If you're considering these strategies, here’s a quick overview:

- Yield Farming: Involves lending your assets in return for interest and rewards, typically in the form of additional tokens.

- Staking: Involves locking up your cryptocurrency in a wallet to support network operations, earning rewards in return.

- Both methods carry risks, so understanding the platforms and protocols is crucial!

By exploring yield farming and staking, you can potentially enhance your investment returns while contributing to the broader crypto ecosystem!

Engaging with the 2025 Crypto Community

Staying connected within the crypto community is just as important as understanding market trends. Engaging with others can lead to valuable insights that might not be readily available in mainstream news. Let's dive into how to effectively engage!

How to Stay Informed and Connected in the Crypto Space

In a rapidly changing environment like cryptocurrency, keeping informed is key. Here are some effective ways to stay in the loop:

- Subscribe to newsletters from trustworthy sources like Uncensored Crypto

- Participate in forums and discussion platforms such as Reddit and Telegram

- Attend webinars and conferences focusing on crypto education

Engaging consistently with the community not only keeps you informed but also builds relationships with fellow enthusiasts!

Encouraging Diverse Perspectives and Ongoing Learning

Diversity of thought is crucial in any investment strategy. By encouraging diverse perspectives, we can better analyze market movements and trends. Here’s how you can foster this environment:

- Join local meetups or online groups that focus on crypto investing

- Share your insights and experiences to inspire others

- Be open to constructive feedback and new ideas from fellow investors

By continually learning and sharing, you not only enhance your own understanding but also contribute to a more informed and inclusive community.

Utilizing Digital Wallets and Security Measures for Safe Investments

Security should always be a priority for any crypto investor. With the rise of hacking incidents and scams, using digital wallets effectively is essential. Here are some best practices for keeping your investments safe:

- Use hardware wallets for storing large amounts of cryptocurrency

- Enable two-factor authentication on all accounts

- Regularly update your passwords and security settings

By implementing these security measures, you can protect your digital assets and invest with peace of mind!

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Monitor market volatility influenced by macroeconomic factors.

- Watch for rising institutional adoption to enhance cryptocurrency legitimacy.

- Understand decentralized finance (DeFi) as a disruptor of traditional banking.

- Keep an eye on regulatory changes and their implications on investments.

- Evaluate market capitalization trends to gauge investor sentiment.

- Stay informed about technological innovations impacting the crypto landscape.

- Adopt effective risk management strategies for uncertain market conditions.

- Engage with the crypto community for diverse insights and networking opportunities.